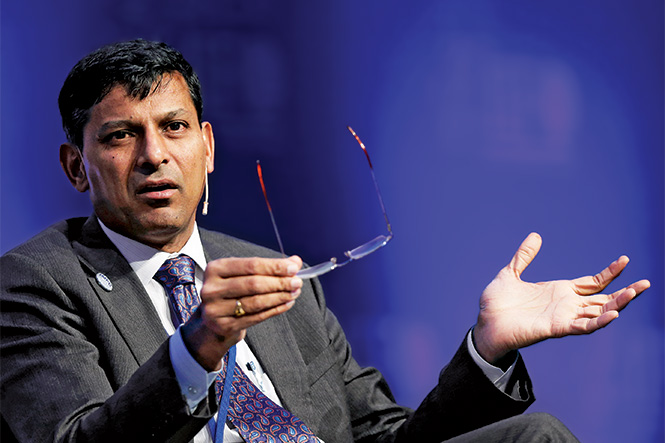

Outgoing RBI Governor Raghuram Rajan rejected the idea of the government taking a special dividend from the central bank for recapitalisation of public sector lenders, saying ‘there is no free lunch’.

“A fundamental lesson in economics is there is no free lunch. This can be seen in the matter of the RBI dividend: Some commentators seem to suggest that public sector banks could be recapitalised entirely if only the RBI paid a larger dividend to the government. Let me explain why matters are not so simple,” he said here.

Explaining the entire ecosystem of earning surplus by the RBI, he said, the central bank earns income out of government assets and printing of currency as well as issuance of deposits to commercial banks.

The suggestion of use of dividend of the RBI for recapitalisation of PSU banks was made by Chief Economic Adviser Arvind Subramanian in the latest Economic Survey.

“Much of the surplus we make comes from the interest we get on government assets or from the capital gains we make off other market participants. When we pay this to the government as dividends, we are putting back into the system the money we made from it there is no additional money printing or reserve creation involved,” he said.

“But when we pay a special dividend to the government, we have to create additional permanent reserves, or more colloquially, print money,” he said.

“Every year, we have in mind a growth rate of permanent reserves consistent with the economy’s cash needs and our inflation goals,” he added.

Given that budgeted growth rate, he said, to accommodate the special dividend RBI will have to withdraw an equivalent amount of money from the public by selling government bonds in the portfolio or alternatively doing fewer open market purchases than budgeted.

The government can use the special dividend to spend, reducing its public borrowing by that amount, he said, adding, but the RBI will have to sell bonds of exactly that amount to the public in order to stick to its target for money creation.

“The overall net sale of government bonds by the government and the RBI combined to the public (that is, the effective public sector borrowing requirement) will not change. But the entire objective of financing government spending with a special RBI dividend is to reduce overall government bond sales to the public. That objective is not achieved,” he said.

The bottomline is that the RBI should transfer to the government the entire surplus, retaining just enough buffers that are consistent with good central bank risk management practice, he said.

From Agencies, Feature image courtesy canadianbusiness