Currency printing presses are running at “full capacity” to sustain demand for new notes, RBI said on Saturday, while asking people to switch to other modes of payment such as debit and credit cards to reduce strain on bank branches.

Adequate stock of all currency notes has been kept ready at more than 4,000 locations across the country, and bank branches are linked to them for sourcing their requirements, RBI said.

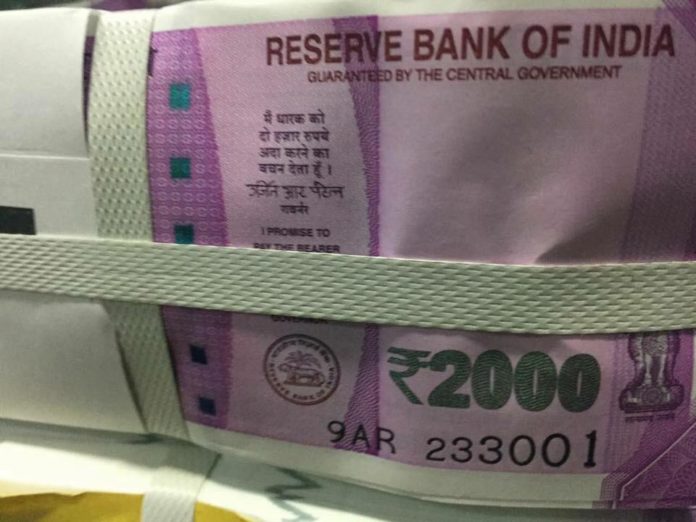

“To sustain the demand, Printing Presses are printing the currency notes at full capacity so that adequate quantum of notes is available,” the central bank said in a statement.

RBI said the scrapping of INR 500/1,000 notes cast a huge responsibility on the banking system to “swiftly withdraw” the currency in a smooth and non-disruptive way and to provide new notes of other denominations.

It also entailed swift withdrawal of the scrapped notes from ATMs within a few hours of the announcement made on evening of November 8 by Prime Minister Narendra Modi.

RBI further said it also involved recalibrating ATMs for issuance of other legal tender notes and reloading them in a matter of two days and providing the exchange facility, just after a day from the announcement.

“While these efforts are afoot, public are encouraged to switch over to alternative modes of payment, such as pre-paid cards, Rupay/Credit/Debit cards, mobile banking, internet banking. All those for whom banking accounts under Jan Dhan Yojana are opened and cards are issued are urged to put them to use,” RBI said.

Such usage, RBI added, will “alleviate the pressure” on physical currency and also enhance the experience of living in the digital world.

On November 10, about 10 crore exchange transactions have been reported. Further, banks and RBI are kept open on Saturday and Sunday to meet the urgent requirements of public and to ease the situation.

The scheme for exchange of the specified bank notes for other denominations is available all across the country till December 30, 2016 and even beyond, at specified RBI offices.

From Agencies, Feature image courtesy newsfultoncounty