This article belongs to the Wall Street Journal and is authored by GABRIELE PARUSSINI, RAYMOND ZHONG and NEWLEY PURNELL

Early last month, Prime Minister Narendra Modi summoned his cabinet to a room in India’s capital, told them to leave their cellphones outside and delivered a shocker: He was about to go on national television to declare that almost 90% of the country’s paper money would no longer be legal tender.

The move, prepared in secret by Mr. Modi and his advisers, kicked off a radical experiment in government control and instantly put India at the forefront of a nascent global campaign against cash. The European Central Bank has said it would stop printing the €500 note in 2018. Canada and Singapore have phased out their large-denomination bills. The Philippines, Denmark and others are tweaking regulations to nudge citizens to switch to electronic payments.

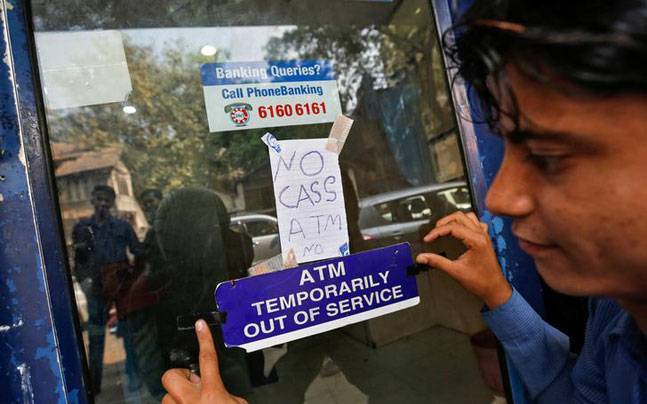

But no one has gone as far as Mr. Modi. Aiming to cut back tax dodging, terrorism and government corruption, he made India’s largest bank note and one of its most commonly used ones—the functional equivalents of America’s $100 and $20 bills—unusable overnight. Indians can deposit the discontinued bills in a bank before the end of the year to preserve their value. New bills are being rolled out, but so far they amount to only about a quarter of the $230 billion in cash that was voided.