Seeking to stem the flow of blackmoney in polls, the Election Commission has urged the government to amend laws to ban anonymous contributions of Rs 2000 and above made to political parties.

There is no constitutional or statutory prohibition on receipt of anonymous donations by political parties. But there is an “indirect partial ban” on anonymous donations through the requirement of declaration of donations under section 29C of The Representation of the People Act, 1951.

But, such declarations are mandated only for contributions above Rs 20,000.

As per the proposed amendment, sent by the Commission to the government, and made part of its compendium on proposed electoral reforms, “anonymous contributions above or equal to the amount of Rs two thousand should be prohibited.”

Only yesterday, the government had said that political parties depositing old 500 and 1,000 rupee notes in their accounts will be exempt from income tax provided the donations taken are below Rs 20,000 per individual and properly documented.

Revenue Secretary Hasmukh Adhia said the government is not tinkering with the tax exemption available to political parties and they are free to deposit old 500 and 1000 rupee notes in their bank accounts. But these deposits will, however, be subject to the condition that individual donations taken in cash do not exceed Rs 20,000 and are properly documented with full identity of the donor.

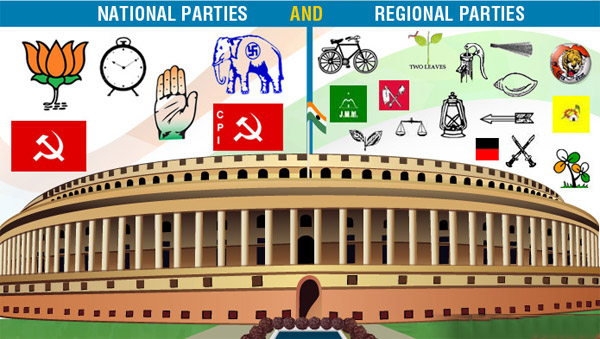

The Commission has also proposed that exemption of Income Tax should only be extended to political parties that contest elections and win seats in Lok Sabha or assembly polls.

Section 13A of the Income-tax Act, 1961 confers tax exemption to political parties for income from house property, income by way of voluntary contributions, income from capital gains and income from other sources.

Only income under the head ‘salaries and income from business or profession’ are chargeable to tax in the hands of political parties in India.

From Agencies, Feature image courtesy erewise