BEIJING: Asian stock markets were mostly higher Monday after Wall Street ended the week up, a Turkish military coup failed and China reported better economic data.

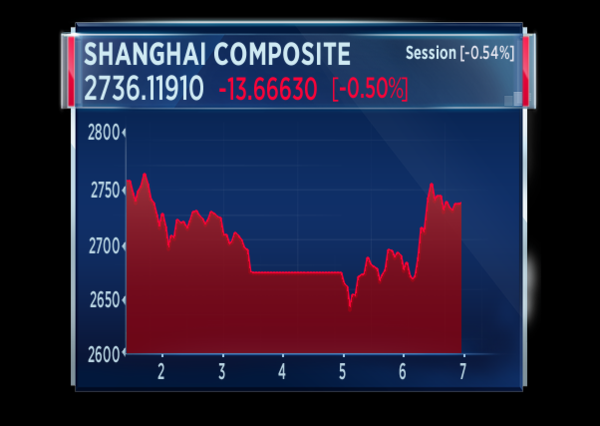

KEEPING SCORE: Hong Kong’s Hang Seng index gained 0.2 percent to 21,693.96 points and Sydney’s S&P-ASX 200 advanced 0.5 percent to 5,456.70. India’s Sensex rose 0.5 percent to 27,987.03 and benchmarks in Taiwan, Singapore and New Zealand also gained. The Shanghai Composite Index shed 0.2 percent to 3,051.82. Japanese markets were closed for a holiday.

WALL STREET: All three major stock indexes ended up for a third straight week after the government reported stronger consumer sales. The Commerce Department said retail spending rose 2.7 percent in June from a year earlier. The Labor Department reported consumer prices rose a modest 1 percent in June from a year ago, suggesting that the Federal Reserve may take its time raising interest rates from the record lows that have helped push stocks higher. The Dow Jones industrial average gained 10.14 points, or 0.1 percent, to 18,516.55. The Standard & Poor’s 500 index slipped 2.01 points, or 0.1 percent, to 2,161.74. The Nasdaq composite lost 4.47 points, or 0.1 percent, to end at 5,029.59.

TURKEY’S COUP: Emerging market stocks were jolted by Friday’s failed coup attempt, but financial analysts said the downturn was likely to be short. The Russian ruble, Mexican peso, South African rand and other currencies fell against the dollar. “A bit of a pullback may be in order in the wake of the Turkish coup, but the hunt for yield in this global low rate environment is likely to see funds flow back in into higher yielding EM assets,” Angus Nicholson of IG said in a report.

CHINA’S OUTLOOK: Growth in the world’s second-largest economy held steady at 6.7 percent over a year earlier in the second quarter of the year, supported by better-than-expected factory output and retail sales. That prompted suggestions that efforts to reverse a steady decline in growth are gaining traction, though some analysts warned the second half might be more challenging. “The outlook towards risk assets is further supported by better than expected China data,” Citigroup analysts said in a report.