Amidst mounting bad loans, India’s Finance Minister Arun Jaitley will hold a meeting with the heads of public sector banks on September 16 to find ways to deal with the situation.

“The Finance Minister will review the first quarter performance of public sector banks and financial institutions on September 16,” sources said.

Besides, he will also discuss credit growth and bad loan situation, they said, adding that the various recovery measures by banks and the legislative steps taken by the government to expedite recovery are also part of the agenda.

The banks have stepped up efforts as far as recovery of bad loans is concerned, the sources added.

Gross NPA of the public sector banks have surged from 5.43 per cent (INR 2.67 lakh crore) in 2014-15 to 9.32 per cent (INR 4.76 lakh crore) in 2015-16.

As per the latest Financial Stability Report by RBI, the Gross Non-Performing Assets ratio for public sector banks may go up to 10.1 per cent by March 2017 under the baseline scenario.

Many banks including Bank of India, Dena Bank, and Central Bank of India, reported losses for the quarter ended June 30, due to a sharp jump in provisions for NPAs on account of an asset quality review mandated by the Reserve Bank of India (RBI) in December.

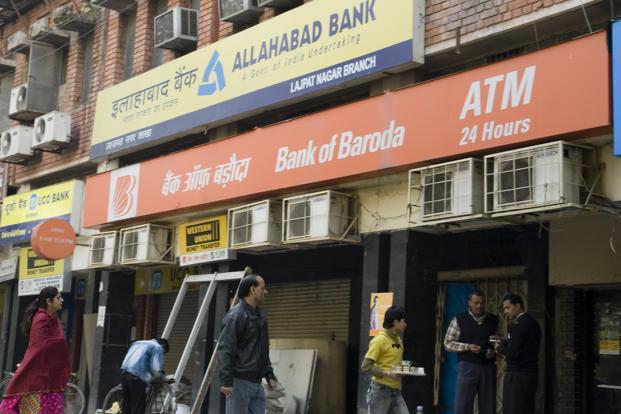

At the same time, a number of banks including the country’s largest lender SBI witnessed a 78 per cent drop in consolidated profit to INR 1,046 crore as against INR 4,714 crore profit in the same quarter a year ago. Besides, Bank of Baroda, Andhra Bank and Union Bank of India among others posted massive decline in profit.

In a bid to shore up cash-strapped public sector banks, the government last month announced infusion of INR 22,915 crore capital in 13 lenders including State Bank of India (SBI) and Indian Overseas Bank to revive loan growth that has hit a two-decade low.

This is the first tranche of capital infusion for the current fiscal and more funds would be provided in future depending on the performance of PSBs.

From Agencies, Feature image courtesy livemint